Back

9 Jan 2020

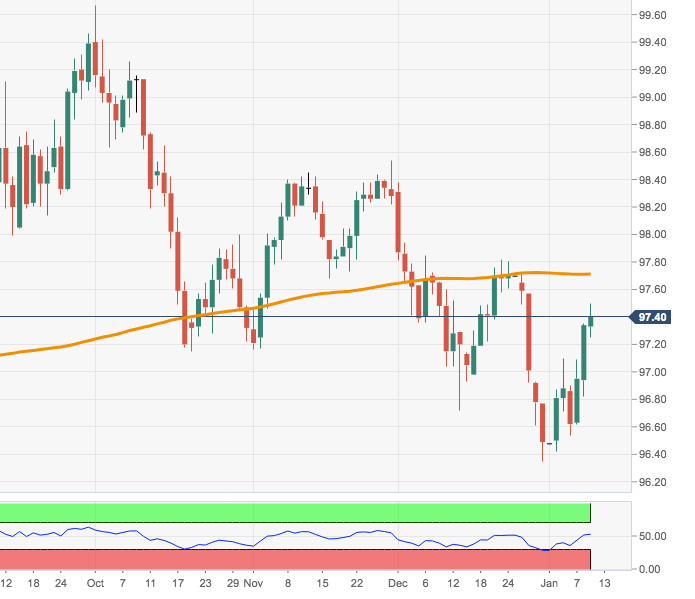

US Dollar Index Technical Analysis: Green light for a test of 97.70

- DXY keeps pushing further north of the 97.00 handle.

- The immediate target is now the 200-day SMA around 97.70.

DXY is navigating the area of fresh 2019 highs in the mid-97.00s, up for the third day in a row and extending the bounce off lows in the 96.30 region seen in past sessions.

Above the key 200-day SMA, today at 97.69, the index is expected to regain the constructive outlook.

If the buying interest gathers extra pace, then the 98.00 neighbourhood should come into focus, reinforced by the proximity of a Fibo retracement of the 2017-2018 drop at 97.87 and the 100-day SMA, today at 97.96.

DXY daily chart